Following are some of the key quotes from the central banks that meet over the past week:

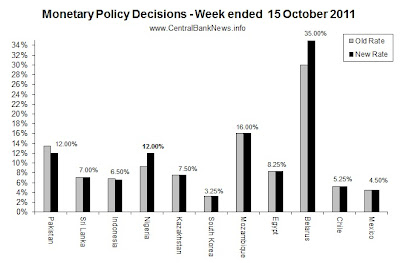

- Central Bank of Nigeria (increased rate +275bps to 12.00%): "The global economic horizon remains highly uncertain, with the signs getting more ominous as policy makers find it increasingly difficult to take the necessary economic decisions that may avert a new wave of recession."

- Bank Indonesia (cut interest rate -25bps o 6.50%): "We are bringing the policy rate to a level that is more reasonable," further noting "we saw the 6.75 percent rate as too high, unless we estimated inflation next year to be very high."

- Bank of Korea (held rate at 3.25%): "Based on currently available information, the Committee considers that, while emerging market economies have shown favorable performances, major advanced economies have exhibited signs of sluggishness. Going forward the Committee forecasts that the global economy will show a recovery, albeit a moderate one; nevertheless, the Committee judges that downside risks to growth have expanded."

- Monetary Authority of Singapore (eased policy): "Given the stresses and fragility in the advanced economies, the prospects for growth in Singapore's major trading partners have deteriorated. With the slowdown in demand, growth in the Singapore economy could fall below its potential rate of 3-5%. Thus, core inflation should ease next year, although headline inflation could stay elevated in the near term reflecting the higher imputed rental cost of owner-occupied housing.

- National Bank of Belarus (increased rate +500bps to 35%): "The move is next step in the consistent implementation of the general economic policy of the National Bank and the Government aimed at macroeconomic stabilization, reducing the pressure on the Belarusian ruble exchange rate and reducing inflation. The National Bank jointly with the Government of the Republic of Belarus will continue the adoption of stabilization measures in the light of internal and external economic developments."

- State Bank of Pakistan (cut rate -150bps to 12.00%): "There is a decline in CPI inflation and government borrowing from SBP is lower than its end-June level. Led by consistent inflow of workers' remittances the external current account position is comfortable though there has been some decline in SBP's foreign exchange reserves. Importantly, concerns regarding weak private sector credit growth and falling real private investment expenditures remain along with a likelihood of rise in real interest rates."

Looking at the central bank calendar, next week will see more emerging market central bank action, with the main event looking to be Brazil - last month Brazil unexpectedly cut interest rates, so the market will be watching that decision closely. Other than policy meetings there's also the Reserve Bank of Australia's October meeting minutes, Ben Bernanke speaks in Boston, the US Fed puts its Beige Book Economic Survey report out, and the Bank of England publishes the minutes from its most recent meeting.

- THB - Thailand (Bank of Thailand) expected to hold at 3.50% on the 19th of Oct

- NOK - Norway (Norges Bank) expected to hold at 2.25% on the 19th of Oct

- BRL - Brazil (Banco Central do Brasil) may cut 25bps from 12.00% on the 19th of Oct

- PHP - Philippines (Bangko Sentral ng Pilipinas) expected to hold at 4.50% on the 20t of Oct

- TRY - Turkey (Central Bank of the Republic of Turkey) expected to hold at 5.75% on the 20th of Oct

Source: www.CentralBankNews.info

0 comments:

Post a Comment