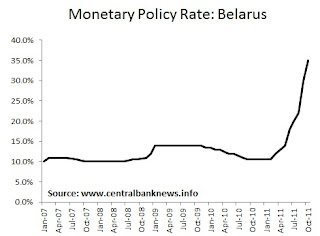

The latest move marks a continued string of aggressive rate increases, with the Bank previously raising the refinancing rate by 300bps to 30%, 500 basis points to 27% and 200 basis points to 22%. The total amount of increases since the start of the year is now 2450 basis points. Belarus reported consumer price inflation of 36.2% in the year to June, according to the National Statistic Committee, meanwhile the government is forecasting 2011 inflation of as much as 39%.

The Bank also said in a separate announcement that interest rates on liquidity management operations would also increase, with the overnight deposit rate rising to 25% and the overnight credit rate rising to 50%. The move "aims to enhance the impact of interest rate policy on the economy, restrictions on lending activity and stabilize the currency market."

The USD-Belarussian ruble (BYR) exchange rate has doubled on the black market, rising to as much as 7,000 per dollar (approx. 6,000 in July), and currently trades around 8750 (5350 this time last month) against the US dollar, according to quotes from Yahoo Finance.

www.CentralBankNews.info

www.CentralBankNews.info

0 comments:

Post a Comment