The Reserve Bank of India (RBI) lowered its repo rate by 25 basis points to 5.75 percent and has now cut it by 75 points this year after it switched from a tightening mode in February in response to the slowdown in global growth and weak inflation.

"A sharp slowdown in investment activity along with a continuing moderation in private consumption growth is a matter of concern," RBI said, adding inflation remains below its target even taking account the expected transmission of its previous two rate cuts.

The rate cut was widely expected by investors after India's gross domestic product grew only 5.8 percent in the first quarter of 2019, or the fourth quarter of fiscal 2018-19, the third quarter in a row of decelerating annual growth rate, as exports decelerated along with fixed capital formation.

RBI's monetary policy committee was unanimous in today's policy decision unlike in April when two of its four members had voted to maintain the rate.

"Global economic activity has been losing pace after a somewhat improved performance in Q1:2019, reflecting further slowdown in trade and manufacturing activity," RBI said, adding:

"Weak global demand due to escalation in trade wars may further impact India's exports and investment activity."

RBI lowered its growth forecast for the current 2019-20 financial year, which began April 1, to 7.0 from April's forecast of 7.2 percent, with risks to the forecast evenly balanced as the stock market remains buoyant and higher financial flows to the commercial sector augured well for investments.

India's headline inflation rate has been picking up in recent months after bottoming at 1.97 percent in January as food prices fell.

In April overall inflation rose to 2.92 percent and food inflation also rose to 1.1 percent, the second consecutive month of an increase after 5 months of deflation.

However, inflation is still well below RBI's 4.0 percent target, and consumer price inflation excluding food and fuel fell to 4.5 percent in April from 5.1 percent in March, the largest monthly decline since April 2017.

Taking into account past rate cuts and expectations of a normal monsoon, RBI forecast inflation of 3.0-3.1 percent for the first half of 2019-20, slightly up from April's forecast of 2.9-3.0 percent.

For the second half of 2019-20, RBI forecast inflation of 3.4-3.7 percent, slightly down from its previous forecast of 3.5-3.8 percent.

The Reserve Bank of India's second bi-monthly monetary policy statement for 2019-20:However, inflation is still well below RBI's 4.0 percent target, and consumer price inflation excluding food and fuel fell to 4.5 percent in April from 5.1 percent in March, the largest monthly decline since April 2017.

Taking into account past rate cuts and expectations of a normal monsoon, RBI forecast inflation of 3.0-3.1 percent for the first half of 2019-20, slightly up from April's forecast of 2.9-3.0 percent.

For the second half of 2019-20, RBI forecast inflation of 3.4-3.7 percent, slightly down from its previous forecast of 3.5-3.8 percent.

"On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today decided to:

- reduce the policy repo rate under the liquidity adjustment facility (LAF) by 25 basis points to 5.75 per cent from 6.0 per cent with immediate effect.

Consequently, the reverse repo rate under the LAF stands adjusted to 5.50 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.0 per cent.

The MPC also decided to change the stance of monetary policy from neutral to accommodative.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

2. Global economic activity has been losing pace after a somewhat improved performance in Q1:2019, reflecting further slowdown in trade and manufacturing activity. Among advanced economies (AEs), economic activity in the US strengthened in Q1, supported by higher government spending, increase in private investment and a lower trade deficit. However, factory activity and retail sales moderated in April. Economic activity in the Euro area has remained weak due to muted industrial activity and weak business confidence. Leading indicators point to a further slowdown in the Euro area in Q2. In the UK, GDP growth for Q1 picked up on high retail sales and government expenditure. However, the outlook is clouded by uncertainty relating to Brexit. The Japanese economy accelerated in Q1 on net exports gains and increased public investment. In April, industrial production improved, while retail sales fell.

3. Economic activity has slowed in many emerging market economies (EMEs). In Q1:2019, the Chinese economy grew at the same pace as in the previous quarter, though slightly above consensus expectations. However, incoming data on industrial production and retail sales suggest that the growth momentum may weaken in Q2. The Russian economy, which had shown some signs of recovery in Q4:2018, weakened in Q1 on muted domestic activity and trade. Economic activity in South Africa contracted in Q1 pulled down mainly by a sharp decline in manufacturing activity. Brazil’s economy contracted in Q1 for the first time since 2016 and there are fears that it could return to recession.

4. Crude oil prices remained volatile, reflecting evolving demand-supply conditions underpinned by the production stance of the OPEC plus, rising shale output, weakening global demand and geo-political concerns. The strengthening of the US dollar had weakened gold prices; however, prices picked up since the last week of May on escalating trade tensions, reviving its demand as a safe haven asset. Inflation remains below target in several economies, though it has shown an uptick since March.

5. Financial markets have been driven by uncertainties surrounding US-China trade negotiations and Brexit. In the US, the equity market has experienced some selling pressures since early May on escalation of trade tensions with China and recently, with Mexico. Equity markets in most EMEs have lost steam due to the waning risk appetite on rising geo-political uncertainties and weakening global trade prospects. Bond yields in the US picked up in April on better GDP data for Q1, but declined in May on subdued economic data and expectations of a dovish monetary policy stance. Bond yields in Germany slipped into negative territory on weak economic data; in Japan, they remained negative on indications of sustained accommodation. In many EMEs, bond yields have been falling with central banks adopting accommodative monetary policy to boost economic growth. In currency markets, the US dollar strengthened on better than expected domestic economic data for Q1. Most EME currencies have depreciated against the US dollar.

Domestic Economy

6. Turning to the domestic economy, on May 31, 2019 the National Statistical Office (NSO) released quarterly estimates of gross domestic product (GDP) for Q4:2018-19 and provisional estimates of national income for 2018-19. GDP growth for 2018-19 has been estimated at 6.8 per cent year-on-year (y-o-y), down by 20 basis points from the second advance estimates released on February 28, pulled down by a downward revision in private final consumption expenditure (PFCE) and moderation in exports. Quarterly data show that domestic economic activity decelerated sharply to 5.8 per cent in Q4:2018-19 from 6.6 per cent in Q3 and 8.1 per cent in Q4:2017-18. Gross fixed capital formation (GFCF) growth declined sharply to 3.6 per cent, after remaining in double digits in the previous five quarters. Private consumption growth also moderated. The drag on aggregate demand from net exports increased in Q4 due to a sharper deceleration in exports relative to imports. However, the overall slowdown in growth was cushioned by a large increase in government final consumption expenditure (GFCE).

7. On the supply side, agriculture and allied activities contracted, albeit marginally, in Q4:2018-19 due to a decline in rabi production. According to the third advance estimates, foodgrains production at 283.4 million tonnes for 2018-19 was lower by 0.6 per cent compared with the previous year mainly due to lower production of rabi rice, pulses and coarse cereals. However, there has been a catch-up in foodgrains production relative to earlier estimates. Foodgrains stocks at 72.6 million tonnes as on May 16, 2019 were 3.4 times the prescribed buffer norms. Growth in manufacturing activity weakened sharply to 3.1 per cent from 6.4 per cent in the previous quarter. Service sector growth, however, accelerated, supported by financial, real estate and professional services, and public administration, defence and other services. In contrast, construction activity slowed down markedly.

8. Moving beyond Q4, the India Meteorological Department (IMD) has predicted that south-west monsoon rainfall (June to September) is likely to be normal at 96 per cent of the long period average (LPA). The current weak El Niño conditions over the Pacific are likely to continue during the monsoon. However, currently prevailing neutral Indian Ocean Dipole (IOD) conditions may turn positive in the middle of the monsoon season and persist thereafter, which augur well for the rainfall outlook.

9. Growth in eight core industries decelerated sharply in April, pulled down largely by coal, crude oil, fertilisers and cement. Credit flows from banks to large industries strengthened, though they remained muted for micro, small and medium industries. Based on early results of the Reserve Bank’s order books, inventory and capacity utilisation survey (OBICUS), capacity utilisation (CU) in the manufacturing sector improved to 77 per cent in Q4 from 75.9 per cent in Q3; seasonally adjusted CU, however, slipped marginally to 75.2 per cent in Q4 from 75.8 per cent in Q3. The business assessment index (BAI) of the industrial outlook survey (IOS) in Q1:2019-20 remained unchanged at its level in the previous quarter. Imports of capital goods – a key indicator of investment activity – remained anaemic in April. However, the manufacturing purchasing managers’ index (PMI) edged up to 52.7 in May with strengthening of output, new orders and employment.

10. High frequency indicators suggest moderation in activity in the service sector. Sales of commercial vehicles, tractors, passenger cars, and three and two wheelers contracted in April. Railway freight traffic growth decelerated. Domestic air passenger traffic growth contracted in March, but turned around modestly in April. Two key indicators of construction activity, viz., cement production and steel consumption, slowed down in April. The PMI services index moderated to 50.2 in May on subdued growth of new businesses.

11. Retail inflation, measured by y-o-y change in CPI, remained unchanged in April, at its March level of 2.9 per cent, with higher inflation in food and fuel groups being offset by lower inflation in items excluding food and fuel.

12. The April food inflation print showed an increase to 1.4 per cent from 0.7 per cent in March. Within the food group, vegetables moved out of nine months of deflation. However, three sub-groups, viz., fruits, pulses and sugar, remained in deflation in April, though the extent of deflation moderated. Among other food sub-groups, inflation in prices of milk, oils and fats, spices, non-alcoholic beverages and prepared meals moderated, while inflation in meat, fish and eggs prices ticked up.

13. Inflation in the fuel and light group rose to 2.6 per cent in April from the February trough of 1.2 per cent, pulled up by prices of liquified petroleum gas due to an increase in international prices. Inflation in subsidised kerosene also rose, reflecting the impact of the calibrated increase in its administered price. Electricity prices moved out of three months of deflation in April. Prices of rural fuel consumption items – firewood, chips and dung cake – moved into deflation.

14. CPI inflation excluding food and fuel fell sharply to 4.5 per cent in April from 5.1 per cent in March – the largest monthly decline since April 2017. The moderation in inflation was broad-based, with household goods and services, and personal care and effects sub-groups registering the largest fall in April; housing inflation was the lowest since June 2017, reflecting softening in house rents in urban areas. Inflation in clothing and footwear also touched its historical low in the new all-India CPI series. Inflation in education, health and transportation and communication moderated as well.

15. Inflation expectations of households in the May 2019 round of Reserve Bank’s survey declined by 20 basis points for the three-month ahead horizon compared with the previous round, but remained unchanged for the one-year ahead horizon. However, manufacturing firms participating in the Reserve Bank’s industrial outlook survey expect input cost pressures to intensify on account of higher raw material costs and salaries in Q2. Input price pressures eased in both agricultural and industrial raw materials. Nominal growth in rural wages and in organised sector staff costs remained muted.

16. Liquidity in the system turned into an average daily surplus of ₹66,000 crore (₹660 billion) in early June after remaining in deficit during April and most of May due to restrained government spending. The Reserve Bank injected liquidity of ₹70,000 crore (₹700 billion) in April and ₹33,400 crore (₹334 billion) in May on a daily net average basis under the LAF. It conducted two OMO purchase auctions in May amounting to ₹25,000 crore (₹250 billion) and a US dollar buy/sell swap auction of US$ 5 billion (₹34,874 crore) for a tenor of 3 years in April to inject durable liquidity into the system. The weighted average call money rate (WACR) – the operating target of monetary policy – remained broadly aligned with the policy repo rate: it traded above the policy repo rate (on an average) by 6 bps in April, but below the policy repo rate by 6 bps in May. The Reserve Bank has announced that it would conduct an OMO purchase auction of ₹15,000 crore (₹150 billion) on June 13, 2019.

17. Transmission of the cumulative reduction of 50 bps in the policy repo rate in February and April 2019 was 21 bps to the weighted average lending rate (WALR) on fresh rupee loans. However, the WALR on outstanding rupee loans increased by 4 bps as the past loans continue to be priced at high rates. Interest rates on longer tenor money market instruments remained broadly aligned with the overnight WACR, reflecting near full transmission of the reduction in policy rate.

18. Exports were unable to sustain the growth of 11.8 per cent observed in March 2019; they grew by 0.6 per cent in April 2019 dragged down by engineering goods, gems and jewellery, and leather products. Imports grew at a somewhat accelerated pace in April 2019 relative to the preceding month, driven by imports of petroleum (crude and products), gold and machinery. This led to a widening of the trade deficit, both sequentially and on a y-o-y basis. Provisional data suggest that net services exports in Q4:2018-19 were broadly comparable to their level a year ago which bode well for the current account balance. On the financing side, net foreign direct investment flows were stronger in Q4:2018-19 than a year ago. After a sharp recovery in March 2019, net foreign portfolio inflows were relatively modest at US$ 2.3 billion in 2019-20 in April-May. While the equity segment received net inflows during this period, the debt segment witnessed net outflows. India’s foreign exchange reserves were at US$ 421.9 billion on May 31, 2019.

Outlook

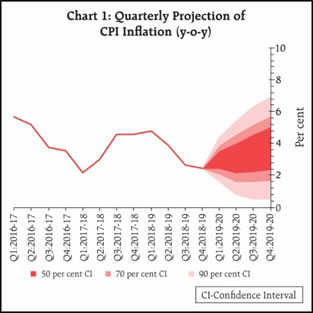

19. In the bi-monthly monetary policy resolution of April 2019, CPI inflation was projected at 2.4 per cent for Q4:2018-19, 2.9-3.0 per cent for H1:2019-20 and 3.5-3.8 per cent for H2:2019-20, with risks broadly balanced. The headline inflation outcome in Q4 at 2.5 per cent was largely in alignment with the April policy projections.

20. The baseline inflation trajectory for 2019-20 is shaped by several factors. First, the summer pick-up in vegetable prices has been sharper than expected, though this may be accompanied by a correspondingly larger reversal during autumn and winter. More recent information also suggests a broad-based pick-up in prices in several food items. This has imparted an upward bias to the near-term trajectory of food inflation. Second, a significant weakening of domestic and external demand conditions appear to have led to a sharp broad-based decline of 60 bps in inflation excluding food and fuel in April; this has imparted a downward bias to the inflation trajectory for the rest of the year. Third, crude prices have continued to be volatile. However, its impact on CPI inflation has been muted so far due to incomplete pass-through. Fourth, near-term inflation expectations of households have continued to moderate. Taking into consideration these factors, the impact of recent policy rate cuts and expectations of a normal monsoon in 2019, the path of CPI inflation is revised to 3.0-3.1 per cent for H1:2019-20 and to 3.4-3.7 per cent for H2:2019-20, with risks broadly balanced (Chart 1).

21. Risks around the baseline inflation trajectory emanate from uncertainties relating to the monsoon, unseasonal spikes in vegetable prices, international fuel prices and their pass-through to domestic prices, geo-political tensions, financial market volatility and the fiscal scenario.

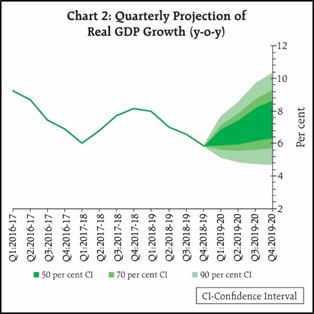

22. In the April policy, GDP growth for 2019-20 was projected at 7.2 per cent – in the range of 6.8-7.1 per cent for H1 and 7.3-7.4 per cent for H2 – with risks evenly balanced. Data for Q4:2018-19 indicate that domestic investment activity has weakened and overall demand has been weighed down partly by slowing exports. Weak global demand due to escalation in trade wars may further impact India’s exports and investment activity. Further, private consumption, especially in rural areas, has weakened in recent months. However, on the positive side, political stability, high capacity utilisation, the uptick in business expectations in Q2, buoyant stock market conditions and higher financial flows to the commercial sector augur well for investment activity. Taking into consideration the above factors and the impact of recent policy rate cuts, GDP growth for 2019-20 is revised downwards from 7.2 per cent in the April policy to 7.0 per cent – in the range of 6.4-6.7 per cent for H1:2019-20 and 7.2-7.5 per cent for H2 – with risks evenly balanced (Chart 2).

23. The MPC notes that growth impulses have weakened significantly as reflected in a further widening of the output gap compared to the April 2019 policy. A sharp slowdown in investment activity along with a continuing moderation in private consumption growth is a matter of concern. The headline inflation trajectory remains below the target mandated to the MPC even after taking into account the expected transmission of the past two policy rate cuts. Hence, there is scope for the MPC to accommodate growth concerns by supporting efforts to boost aggregate demand, and in particular, reinvigorate private investment activity, while remaining consistent with its flexible inflation targeting mandate.

24. Against this backdrop, all members of the MPC (Dr. Chetan Ghate, Dr. Pami Dua, Dr. Ravindra H. Dholakia, Dr. Michael Debabrata Patra, Dr. Viral V. Acharya and Shri Shaktikanta Das) unanimously decided to reduce the policy repo rate by 25 basis and change the stance of monetary policy from neutral to accommodative.

25. The minutes of the MPC’s meeting will be published by June 20, 2019.

26. The next meeting of the MPC is scheduled during August 5 to 7, 2019."

0 comments:

Post a Comment