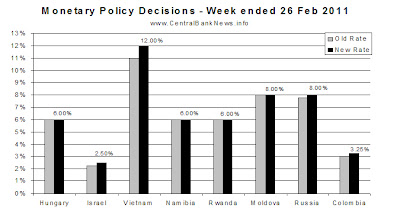

Emerging market monetary policy meetings dominated the central banking headlines during the past week. The banks that announced interest rate decisions included: Hungary, Israel, Vietnam, Namibia, Rwanda, Moldova, Russia, and Colombia. Four of the banks made changes, and all were increases; Israel, Russia, and Colombia increased their rates +25 basis points, while Vietnam made itself the standout again with +100bps to its rate, after a 200 basis point increase the week before. There was also the Bank of Mauritius hiking its reserve ratio 100bps to 7% (and don't forget China's further 50bp increase to its reserve ratio).

The running theme of emerging market inflation was again highlighted this week with all the emerging market monetary policy decisions. The common element in all the statements by the central banks was one of increasing inflation - with a few one-offs affecting agriculture/food supply, causing a spike in inflation. But again, one of the key aspects was commodity prices; agriculture again, but also energy prices - and increasingly the metals complex (though the metals take a more indirect and slow pass through to consumer prices). So keep watching this space on emerging markets inflation - can the central bankers get it under control? and can they do so without stalling their economies?

Next week there's a few majors announcing policy, with the Reserve Bank of Australia, Bank of Canada, and the European Central Bank all announcing interest rate decisions - and all are expected to hold steady, but as always the accompanying statements will make for interesting reading.

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2011/02/monetary-policy-week-in-review-26-feb.html

0 comments:

Post a Comment