The Reserve Bank of India released the following statement by its monetary policy committee and a statement by its governor, Shaktikanta Das:

"On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (December 4, 2020) decided to:

- keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 4.0 per cent.

Consequently, the reverse repo rate under the LAF remains unchanged at 3.35 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 4.25 per cent.

- The MPC also decided to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

2. The outlook for Q4 (October-December) of 2020 is overcast with a surge in COVID-19 infections in a second wave across Europe, the US and major emerging market economies (EMEs), with accompanying lockdowns. Progress on vaccine candidates has, however, generated some offsetting optimism. World trade recorded a rebound in Q3 as lockdowns were eased, but it is likely to slow in Q4 as pent-up demand is exhausted, inventory restocking is completed, and trade-related uncertainty is rising with the second wave. CPI inflation has remained muted across major advanced economies (AEs) while it picked up in some EMEs on firming food prices and supply disruptions. Global financial markets remain buoyant, supported by highly accommodative monetary policies and positive news on the vaccine.

Domestic Economy

3. In India, the data release of the National Statistical Office (NSO) on November 27 showed a contraction of 7.5 per cent in real GDP in Q2:2020-21 (July-September). In Q3:2020-21, high frequency indicators point to a recovery gaining traction, with double digit growth in passenger vehicles and motorcycle sales, railway freight traffic, and electricity consumption in October, although there was moderation in some of these indicators in November. Riding on the favourable monsoon, the outlook for agriculture remains bright, with rabi sowing up 4.0 per cent from the acreage covered at this time last year under supportive soil moisture and reservoir conditions.

4. CPI inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October 2020, with some evidence that price pressures are spreading. Food inflation surged to double digits in October across protein-rich items including pulses, edible oils, vegetables and spices on multiple supply shocks. Core inflation, i.e., CPI excluding food and fuel, also picked up from 5.4 per cent in September to 5.8 per cent in October. Both three months and one year ahead inflation expectations of households have eased modestly in anticipation of the seasonal moderation of food prices in the winter and easing of supply chain disruptions.

5. Domestic financial conditions remained easy in October-November and systemic liquidity continued to be in large surplus. Reserve money increased by 15.3 per cent (y-o-y) (as on November 27, 2020), driven by a surge in currency demand. Money supply (M3), on the other hand, grew by only 12.5 per cent as on November 20, 2020. A noteworthy development is that non-food credit growth accelerated and moved into positive territory for the first time in November 2020 on a financial year basis – hitherto, the large inflow of deposits into the banking system was being predominantly deployed in SLR investment. Corporate bond issuances stood at ₹4.4 lakh crore during April-October 2020 as against ₹3.5 lakh crore during the same period last year. India’s foreign exchange reserves were US$ 574.8 billion (as on November 27), up from US$ 545.6 billion on October 2 at the time of the MPC’s last resolution.

Outlook

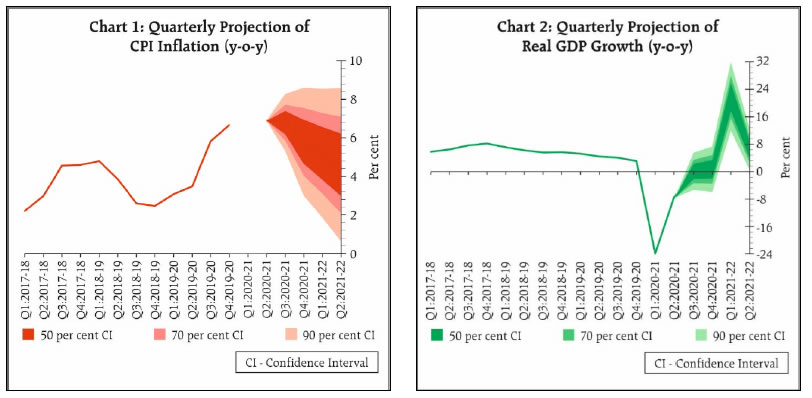

6. The outlook for inflation has turned adverse relative to expectations in the last two months. The substantial wedge between wholesale and retail inflation points to the supply-side bottlenecks and large margins being charged to the consumer. While cereal prices may continue to soften with the bumper kharif harvest arrivals and vegetable prices may ease with the winter crop, other food prices are likely to persist at elevated levels. Crude oil prices have picked up on optimism of demand recovery, continuation of OPEC plus production cuts and are expected to remain volatile in the near-term. Cost-push pressures continue to impinge on core inflation, which has remained sticky and could firm up as economic activity normalises and demand picks up. Taking into consideration all these factors, CPI inflation is projected at 6.8 per cent for Q3:2020-21, 5.8 per cent for Q4:2020-21; and 5.2 per cent to 4.6 per cent in H1:2021-22, with risks broadly balanced (Chart 1).

7. Turning to the growth outlook, the recovery in rural demand is expected to strengthen further, while urban demand is also gaining momentum as unlocking spurs activity and employment, especially of labour displaced by COVID-19. These positive impulses are, however, clouded by a possible rise in infections in some parts of the country, prompting some local containment measures. At the same time, the recovery rate has crossed 94 per cent and there is considerable optimism on successes in vaccine trials. Consumers remain optimistic about the outlook, and business sentiment of manufacturing firms is gradually improving. Fiscal stimulus is increasingly moving beyond being supportive of consumption and liquidity to supporting growth-generating investment. On the other hand, private investment is still slack and capacity utilisation has not fully recovered. While exports are on an uneven recovery, the prospects have brightened with the progress on the vaccines. Demand for contact-intensive services is likely to remain subdued for some time due to social distancing norms and risk aversion. Taking these factors into consideration, real GDP growth is projected at (-)7.5 per cent in 2020-21: (+)0.1 per cent in Q3:2020-21 and (+)0.7 per cent in Q4:2020-21; and (+)21.9 per cent to (+)6.5 per cent in H1:2021-22, with risks broadly balanced (Chart 2).

8. The MPC is of the view that inflation is likely to remain elevated, barring transient relief in the winter months from prices of perishables. This constrains monetary policy at the current juncture from using the space available to act in support of growth. At the same time, the signs of recovery are far from being broad-based and are dependent on sustained policy support. A small window is available for proactive supply management strategies to break the inflation spiral being fuelled by supply chain disruptions, excessive margins and indirect taxes. Further efforts are necessary to mitigate supply-side driven inflation pressures. Monetary policy will monitor closely all threats to price stability to anchor broader macroeconomic and financial stability. Accordingly, the MPC in its meeting today decided to maintain status quo on the policy rate and continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

9. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Mridul K. Saggar, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted for keeping the policy repo rate unchanged. Further, all members of the MPC voted unanimously to continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward.

10. The minutes of the MPC’s meeting will be published by December 18, 2020."

Statement by Governor Shaktikanta Das:

"The Monetary Policy Committee (MPC) met on 2nd, 3rd and 4th December, 2020. It reviewed current macroeconomic and financial developments, both domestic and global, and the evolving outlook for the Indian economy. At the end of its deliberations, the MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent. It also decided to continue with the accommodative stance of monetary policy as long as necessary – at least through the current financial year and into the next year – to revive growth on a durable basis and mitigate the impact of COVID-19, while ensuring that inflation remains within the target going forward. The Marginal Standing Facility (MSF) rate and the Bank rate remain unchanged at 4.25 per cent. The reverse repo rate stands unchanged at 3.35 per cent.

2. I wish to take this opportunity to express my appreciation of all the Committee members for their valuable insights and guidance that contributed to the monetary policy decision taken today. I would also like to thank our teams in the RBI for their analytical and intellectual support, and logistical assistance.

3. Let me begin by setting out the thinking that went into the MPC’s decision today, and its rationale. The MPC was of the view that inflation is likely to remain elevated, with some relief in the winter months from prices of perishables and bumper kharif arrivals. This constrains monetary policy at the current juncture from using the space available to act in support of growth.

At the same time, the signs of recovery are far from being broad-based and are dependent on sustained policy support. A small window is available for proactive supply management strategies to break the inflation spiral being fuelled by supply chain disruptions, excessive margins and indirect taxes. Further efforts are necessary to mitigate supply-side driven inflation pressures. The MPC will monitor closely all threats to price stability to anchor broader macroeconomic and financial stability. Accordingly, the MPC decided today to maintain status quo on the policy rate and continue with the accommodative stance as long as necessary – at least during the current financial year and into the next financial year – to revive growth on a durable basis and mitigate the impact of COVID-19 on the economy, while ensuing that inflation remains within the target going forward.

4. The year 2020 has been extremely challenging. It has tested and stretched our capabilities and even our inner reserves of strength, patience and fortitude. As the year draws to a close, it would be appropriate to review our actions and outcomes as we battled against the pandemic. What stood out, in my view, in this all-out endeavour, was our determination to fight and overcome every trial that was flung at us. I am reminded here of the words of Mahatma Gandhi and I quote: “Strength …….… comes from an indomitable will1.” Drawing lessons therefrom, I shall try to set out our vision for the way forward.

2020: A Year to Remember

5. When the definitive history of this pandemic period is written up, the year 2020 will be recorded as a defining year in the history of modern civilisation, marked by the Great Pandemic, comparable in its scale to the Spanish Flu of 1918, and exceeding the economic losses of the Great Depression of the 1930s. That COVID-19 broke out even as the world was gripped by a synchronised slowdown in activity made the agony even more excruciating. Alongside this human and economic tragedy, history will also record the unprecedented response by central banks and governments, healthcare systems and personnel, civil society organisations and above all, the common people.

6. Together, we have managed to contain human losses, ensured that financial systems and markets functioned normally, kept finance available and flowing, and reached out to the most vulnerable. The result was that near-term financial stability risks have been contained. Economic contractions have started to ease, portfolio flows into emerging markets have recovered and hard currency bond issuances have strengthened for those with stronger credit ratings.

7. Throughout this period, the Reserve Bank acted pre-emptively to face head-on the challenges posed by the virus and manage the fallout of the pandemic on the Indian economy. Our overall endeavour is that going forward, output and employment losses get quickly recouped in an environment of macroeconomic and financial stability.

8. With the preservation of financial stability and depositors’ interest being uppermost in our agenda, we could swiftly resolve the situation at two scheduled commercial banks. We remain strongly committed to preserve the stability of the financial sector and will do whatever is necessary on this front. While we are constantly focused on strengthening the regulations and deepening our supervision, financial sector entities like banks and NBFCs should also give highest priority to quality of goverance, risk management and internal controls. They are the first line of defence in matters relating to financial sector stability.

9. The Reserve Bank’s role as the debt manager and the banker to the government was tested to the hilt in 2020, marked by the highest ever level of market borrowing. Our policies have resulted in the lowest weighted average cost of borrowing in 16 years and the highest weighted average maturity of the stock of public debt on record. The weighted borrowing cost for the centre stands at a new low of 5.82 per cent as on December 1 even with additional borrowings for state governments as against 6.88 per cent during the corresponding period of last year. The government borrowings programme – both centre and the states – has progressed smoothly so far in the year and I would like to reiterate what I said in October - the importance of cooperative solutions for orderly market movements. We need to be competitive and not combative.

Financial Market Outlook

10. The measures taken by the Reserve Bank over the year gone by have also resulted in a significant moderation in the structure of interest rates across the spectrum, narrowing of risk spreads, and a record issuance of corporate bonds. The spread of AAA-rated 3-year corporate bond yields over G-Sec yields of corresponding maturity fell from 60 bps on October 8 to 17 bps on November 27, 2020. The spreads on lower rated corporate bonds also moderated significantly during the same period: by 34 bps each for AA-rated 3-year bonds and BBB- (BBB minus) rated 3-year bonds. The yield on AAA-rated 5-year corporate bonds declined to 5.59 per cent on November 27, 2020 from 5.93 per cent on October 8, 2020. Corporate bond spreads have, in fact, narrowed to pre-pandemic levels across the term structure. Financial markets have been working in an orderly fashion. The easing of financing conditions is, in fact, preparing the ground for strengthening the nascent signs of recovery that have become visible in the second half of 2020-21.

11. These developments attest to the efficacy of the Reserve Bank’s liquidity management measures not just in lowering yields and borrowing costs but also in building positive market sentiment as well as confidence in the assurances given by the RBI in October and actions thereafter to anchor that guidance. Overall bond market conditions have evolved in an orderly manner and engendered congenial conditions for other segments of financial markets that price financial instruments off the G-Sec yield curve. Debt management operations, monetary operations and market expectations are in harmony and share a common outlook. This augurs well for financial stability. I take this opportunity to commend market participants for responsible behaviour and for contributing significantly to producing these positive outcomes. The Reserve Bank, on its part, stands ready to undertake further measures as necessary to assure market participants of access to liquidity and easy financing conditions.

12. In the external front, the hardening of yields in the US reflects the lift from ‘reflation trade’. Prospects of political stability and expectations of fiscal stimulus have churned up risk appetite, causing investors to exit the safe-haven of US treasuries and search for returns. As a consequence, surges of capital flows have flooded into India. The Reserve Bank has been taking measures for dampening volatility and enabling orderly evolution of the exchange rate in consonance with underlying domestic fundamentals. Mindful of the consequences of these actions for domestic liquidity and inflation, the injections of liquidity through forex interventions are being sterilised by absorptions through the reverse repo.

13. We will continue to respond to global spillovers in order to secure domestic stability with our liquidity management operations. The various instruments at our command will be used at the appropriate time, calibrating them to ensure that ample liquidity is available to the system. Instruments like OMO purchases, operation twists and reverse repos will continue to be used. Our paramount objective is to support growth while ensuring that financial stability is maintained and preserved at all times.

Assessment of Inflation and Growth: The Outlook

14. Let me now set out the MPC’s assessment of underlying inflation dynamics and the outlook. CPI inflation rose sharply to 7.3 per cent in September and further to 7.6 per cent in October 2020, with some evidence that price pressures are spreading. The outlook for inflation has turned adverse relative to expectations in the last two months. While cereal prices may continue to soften with the bumper kharif harvest arrivals and vegetable prices may ease with the winter crop, other food prices are likely to persist at elevated levels. Cost-push pressures continue to impinge on core inflation, which could remain sticky. Taking into consideration all these factors, CPI inflation is projected at 6.8 per cent for Q3:2020-21, 5.8 per cent for Q4:2020-21; and 5.2 to 4.6 per cent in H1:2021-22, with risks broadly balanced.

Recovery and Beyond

15. Against this backdrop, we must turn our attention to nurturing the recovery beyond the meeting of pent-up demand and focus on setting it on a firm trajectory of sustained, high quality growth. Data that have become available for Q3:2020-21 confirm that the economy is recuperating faster than anticipated and more sectors are joining the multi-speed upturn that I had highlighted in my statement in October. The contraction in Q2 in the NSO’s end-November preliminary estimates has turned out to be shallower than projected in October.

16. The manufacturing and services purchasing managers’ index (PMI) at 56.3 and 53.7 respectively in November 2020 remain in expansion zone. High frequency indicators of services showed stability and increase in the number of upticks (Annex). The recovery in rural demand is expected to strengthen further, while urban demand is gaining momentum as unlocking spurs activity and employment, especially for labour displaced by COVID-19. These positive impulses are, however, clouded by a possible rise in infections in some parts of the country, prompting some local containment measures. At the same time, the recovery rate has crossed 94 per cent and is rising, with considerable optimism on successes in vaccine trials. Consumer confidence over the year ahead has turned optimistic.

17. Corporate results for Q2:2020-21 indicate that demand conditions are recovering and profit margins are rising on the back of cost saving on expenses and debt servicing capacity has gone up. Business assessment of manufacturing firms has entered the expansion zone in Q3:2020-21 after remaining in contraction in the last two quarters. Business expectations going forward into Q4:2020-21 are rising.

18. Turning to the growth outlook, as I stated earlier, the recovery in rural demand is expected to strengthen further, while urban demand is also gaining monentum. Consumers remain optimistic about the outlook and business sentiment of manufacturing firms is gradually improving. Fiscal stimulus is increasingly moving beyond being supportive of consumption and liquidity to supporting growth-generating investment. On the other hand, private investment is still slack and capacity utilisation has not fully recovered. While exports are on an uneven recovery, the prospects have brightened with the progress on the vaccines. Taking these factors into consideration, real GDP growth is projected at (-) 7.5 per cent in 2020-21: (+) 0.1 per cent in Q3:2020-21 and (+) 0.7 per cent in Q4:2020-21; and 21.9 per cent to 6.5 per cent in H1:2021-22, with risks broadly balanced.

Additional Measures

19. Against this backdrop, the RBI will persevere with its paramount objective of reviving the economy with some additional measures in order to (i) enhance liquidity support to targeted sectors having linkages to other sectors; (ii) deepen financial markets; (iii) conserve capital among banks and NBFCs through regulatory initiatives; (iv) strengthen supervision through strengthening the audit functions; (v) facilitate external trade by improving ease of doing business for exporters; and (vi) upgrade payment system services so as to expand financial inclusion and improve customer service.

(i) Liquidity Measures to Revive Activity

On Tap TLTRO– Extension of Sectors and Synergy with ECLGS 2.0

The on tap targeted long term repo operations announced on 9th October, 2020 will be expanded to cover other stressed sectors in synergy with the credit guarantee available under the Emergency Credit Line Guarantee Scheme (ECLGS 2.0) of the Government. This will encourage banks to extend credit support to stressed sectors at lower cost.

(ii) Deepening Financial Markets

21. The Regional Rural Banks (RRBs) are currently not permitted to access the liquidity windows of the Reserve Bank as well as the call/notice money market. With a view to expanding participation in money markets and to facilitate better liquidity management, Regional Rural Banks will be allowed to access the Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) of the RBI; and also the Call/Notice money market.

22. With the recent enactment of the legislation for Bilateral Netting of financial contracts providing a fillip to the underdeveloped credit derivatives market in India, it has been decided to review the extant guidelines on Credit Default Swaps (CDS) and issue draft directions for public comments shortly. The revised directions are expected to facilitate the development of credit derivatives market and a liquid and vibrant market for corporate bonds, especially for lower rated issuers.

23. In the light of evolution in the financial markets and due to various liberalisation measures undertaken in recent period, the comprehensive guidelines on derivatives, issued in 2011, have been reviewed and draft directions are being issued today for public comments. The revised guidelines seek to promote efficient access to derivative markets while ensuring high standards of governance and conduct in Over The Counter (OTC) derivative business by market makers.

24. Comprehensive draft directions on call, notice and term money markets, Certificate of Deposits (CDs), commercial papers (CPs) and non-convertible debentures (NCDs) with original maturity of less than one year are being released today for public feedback. The revised directions seek to bring consistency across products in terms of issuers, investors and other participants.

(iii) Regulation

(a) Banks

25. In response to the COVID-19 pandemic, the Reserve Bank has focused on resolution of stress among borrowers, and facilitating credit flow to the economy, while ensuring financial stability. In continuation of this effort and to help banks conserve capital, while creating room for fresh lending, it has been decided after a review that commercial and co-operative banks will retain the profits and not make any dividend pay-out from the profits pertaining to financial year 2019-20.

Non-Bank Financial Companies (NBFCs)

26. The growing significance of NBFCs and their interlinkages with different segments in the financial system has made it imperative to enhance the resilience of the sector. Therefore, it has been decided to put in place transparent criteria as per a matrix of parameters for declaration of dividends by different categories of NBFCs. A draft circular containing the proposed criteria and parameters will be released soon for public comments.

27. Further, the current regulatory regime for the NBFC sector, built on the principle of proportionality, warrants a review. It is felt that a scale-based regulatory approach linked to the systemic risk contribution of NBFCs could be the way forward. As part of the stakeholder consultation process, a discussion paper on this subject will be issued before January 15, 2021 for public comments.

(iv) Supervision

28. Supervisory focus in improving the governance and assurance functions in supervised entities (SEs) continues to enage the attention of the RBI. In this endeavor, the following measures are being announced today. These pertain to (i) introduction of Risk based Internal Audit (RBIA) in large UCBs and NBFCs and (ii) harmonisation of guidelines on appointment of Statutory Auditors for commercial banks, UCBs and NBFCs to improve the quality of financial reporting. Details on these measures are in part-B of the statement and guidelines on the above will be issued shortly.

(v) Digital Payments Security

29. In order to significantly improve the ecosystem of digital payment channels with robust security and convenience for users, we propose to issue Reserve Bank of India (Digital Payment Security Controls) Directions for the regulated entities. These directions will contain requirements for robust governance, implementation and monitoring of certain minimum standards on common security controls for channels like internet and mobile banking, card payments, etc. Draft directions in this regard will be issued shortly for public comments.

(vi) Financial Literacy and Education

30. In order to deepen financial inclusion and protect customers by promoting financial literacy, a community led participatory approach through Centres for Financial Literacy (CFL) was implemented by the RBI through select banks and non-governmental organisations as a pilot project in 2017. It is now proposed to expand the reach of the CFLs from 100 blocks currently to every block in the country in a phased manner by March 2024.

(vii) Grievance Redress Mechanism in Banks

31. With a view to enhancing the efficacy of the grievance redress mechanism in banks, it has been decided to put in place a comprehensive framework comprising inter alia (i) enhanced disclosures on customer complaints, (ii) monetary disincentives in the form of recovery of cost of redress of complaints, and (iii) undertaking intensive review of grievance redress mechanisms and supervisory action against regulated entities failing to improve their redress mechanisms.

(viii) External Trade Facilitation

32. The Reserve Bank has announced several measures to enhance export competitiveness, ease of doing business for exporters and minimise procedural delays. Continuing with these efforts, it has been decided to further faciliate external trade by delegating additional powers to Authorised Dealer (AD) banks to (a) regularise cases of direct dispatch of shipping documents by the exporter irrespective of the value of export shipment; (b) write off unrealised export bills without limits in specified circumstances; (c) allow set-off of export receivables against import payables with overseas group/associate companies under certain conditions when both the export and import legs have taken place within the same calendar year; and (d) consider refund of export proceeds without insisting on import of goods which are perishable in nature or had been auctioned/destroyed by port/customs/health authorities/any other accredited agency in the importing country, subject to production of documentary evidence.

(ix) Payment and Settlement Systems

33. The RTGS system will soon be made 24x7. With this enablement, it is proposed to reduce settlement and default risk in the system by facilitating settlement of AePS, IMPS, NETC, NFS, RuPay, UPI transactions on all days of the week. This will make the payments ecosystem more efficient.

34. In order to expand the adoption of digital payments in a safe and secure manner, it is proposed to enhance, at the discretion of the user, the limits for contactless card transactions and e-mandates for recurring transactions through cards (and UPI) from ₹2,000 to ₹5,000 from January 1, 2021.

Conclusion

35. The growth impulses that have emerged augur well for the revitalization of the Indian economy. Policy stimuli by the Government and the RBI are intended to nurture these growth sprouts to greater strength. Efforts are underway to ensure a calibrated unlocking of the economy, with cognisance and caution about the virus. While we remain vigilant, we must now turn to alleviating the scars left by the pandemic and revive the economy. The horizon has lighted up with the spate of positive news on the vaccines, and a steady rise in recoveries. India’s time has come to break free of the fetters of COVID-19 and reconfigure our destiny. We have borne with fortitude and courage the terrible havoc wrought by the pandemic. We have lost lives and loved ones, but not hope, not the conviction that we will overcome and emerge stronger. It is often said that life after COVID will not be the same again, but human endeavour has time and again shown that it is never too late to seek a newer world. We must reach out with a strong will to strive, to seek, to find and not to yield. I am reminded here of a quote attributed to Socrates, “In the face of adversity, we have a choice. We can be bitter, or we can be better”. Obviously we will strive to be better.

Stay safe, stay well. Namaskar."

0 comments:

Post a Comment